No Waste, No Gain

One of the biggest losses in the food supply chain from the get-go is food waste on the agricultural level. However, one company has brought a solution to the problem.

US-based biotechnology start-up, Mi Terro, uses agricultural waste to create compostable packaging material, especially flexible packaging film that is widely used for food, for fashion, or even traditional, ordinary, flexible packaging. The company won HKSTP’s annual and first virtual Elevator Pitch Competition of 2020.

Its technology produces 100 per cent plant-based packaging films, the company claims, which are home compostable, ocean degradable and 3 to 5 times cheaper than other bio-based materials.

The man behind this idea is founder and CEO, Robert Luo. “One of the reasons why we can provide a very low cost material is that we can source our raw material globally by partnering with food companies,” says Luo. “Oftentimes, they have to pay money to get rid of their agricultural waste. Or farmers would buy their waste for a very small amount of money to make into animal feed. At this point, we made them an offer, and presented them with a more technical and eco-friendly solution.”

Mi Terro’s major clients are the US and Japanese markets. The company also received a lot of interest from companies based in Europe, and China has the potential to be a key market.

“China is starting to ban plastic this year [2021] where all non-compostable or non-biodegradable plastic cannot be manufactured or sold on the market,” says Luo, who is referring to an announcement made by China’s National Development and Reform Commission in January. The country generates rubbish of 1.4 billion citizens. In 2017, that equalled 215 million tonnes of urban household waste. Currently, its largest landfill - the size of 100 football fields - is already at full capacity, 25 years ahead of schedule.

The policy includes banning non-degradable bags in major cities by the end of 2020 and in all cities and towns by 2022, with the exemption of markets selling fresh produce until 2025. This includes banning single-use straws in restaurants and reducing their other single-use plastic items by 30 per cent. Hotels are required to stop offering free single-use plastic items by 2025. The production and sale of plastic bags less than 0.025mm thick will also be banned.

China’s special administrative region, Hong Kong, undergoes a different trajectory. The Hong Kong government introduced the Plastic Shopping Bag (PSB) Charging Scheme in 2009 with further enhancement to the measure in 2015 in order to curb plastic shopping bag usage in the city.

However, this scheme does not cover the excessive use of other plastic usage, such as single-use items and plastic packaging. When it comes to PSBs, the scheme also seems to have little effect as statistics by the Environmental Protection Department revealed that the average daily disposal quantity of plastic bags in 2017 reached 793 metric tonnes, which closes in on the record level of 2008 - a year before the implementation of the levy - of 867 metric tonnes. The latest figures in 2019 for PSBs saw a dip to 768 metric tonnes from 2017 .

It has been previously suggested by certain members of the Legislative Council that the government should apply the Producer Responsibility Scheme to regulate producers of single-use plastic products by imposing a pollution levy to those who sell them. A measure akin to those adopted by many Western countries with positive results.

It shows that despite the gargantuan task, governmental financial schemes and incentives can work to move the plastic reduction agenda forward. A trajectory that Mi Terro is undertaking.

Luo’s company has received a government grant from Hangzhou province to launch their project in their district and work closely together. Such public sector partnership gives companies great exposure to form further alliances. “We know we cannot be the only one in this industry to make a difference. We provide our technology to other companies or to existing plastic manufacturers where they don’t have to source fossil fuel-powered plastic pellets but instead our compostable plant-based pellets,” the CEO adds.

“We have been trying to establish partnerships both on the raw material supply end toward downstream, buying customer brands. So far we have seen a lot of successes, a lot of willingness to work with us, especially from big brands such as Budweiser.”

To Luo, the direction of the current corporate agenda towards more active, sustainable practices is an optimistic one. “Five to ten years ago, corporations could greenwash entire sustainability topics, but now consumers are really nitpicky or they understand what the true definition of sustainability is. The word itself is often very manipulative. Companies talk about sustainability in the sense of business and revenue profit growth, and not on environmental concerns. Nowadays, corporations are taking real actions by partnering with innovative companies like ours or have innovative technology developing in-house.”

A recent trend has seen food waste turning into beverages or snacks, and there is also a focus on plant-based AI engineering. But Luo reckons there is a huge potential for nanomaterials and biomaterials to enter the scene.

The global hydrogen film industry is estimated at US$128.8 billion. Luo’s Mi Terro business in mobile, biodegradable film takes about US$1.5 billion of the pie. “We still have a lot of room for growth,” says Luo. “In fact, we think that this is an endless potential for a technology like ours. But in terms of what we want to improve are things like transparency of our films - as it isn’t as clear yet as plastic is, and lowering cost to compete with traditional, classic materials.”

A Flavour for Innovation

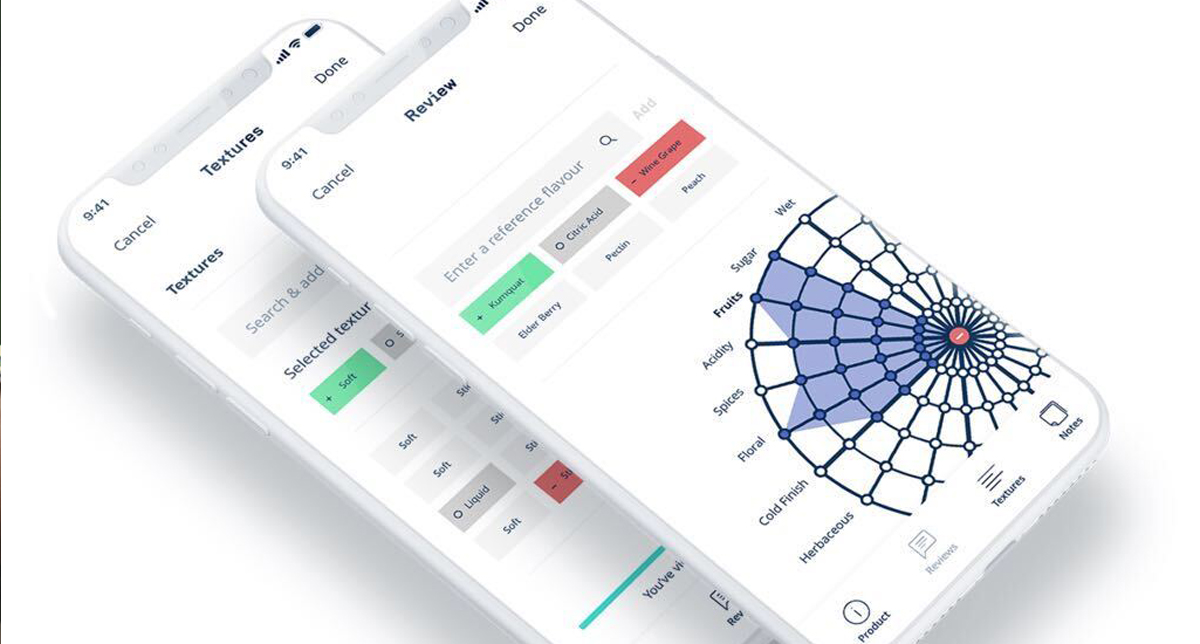

Analytical Flavor Systems (AFS) developed Gastrograph AI to use artificial intelligence (AI) technology that models human sensory perception of flavour, aroma and texture to predict consumer preferences for food and beverage products...

Agricultural progress with AI

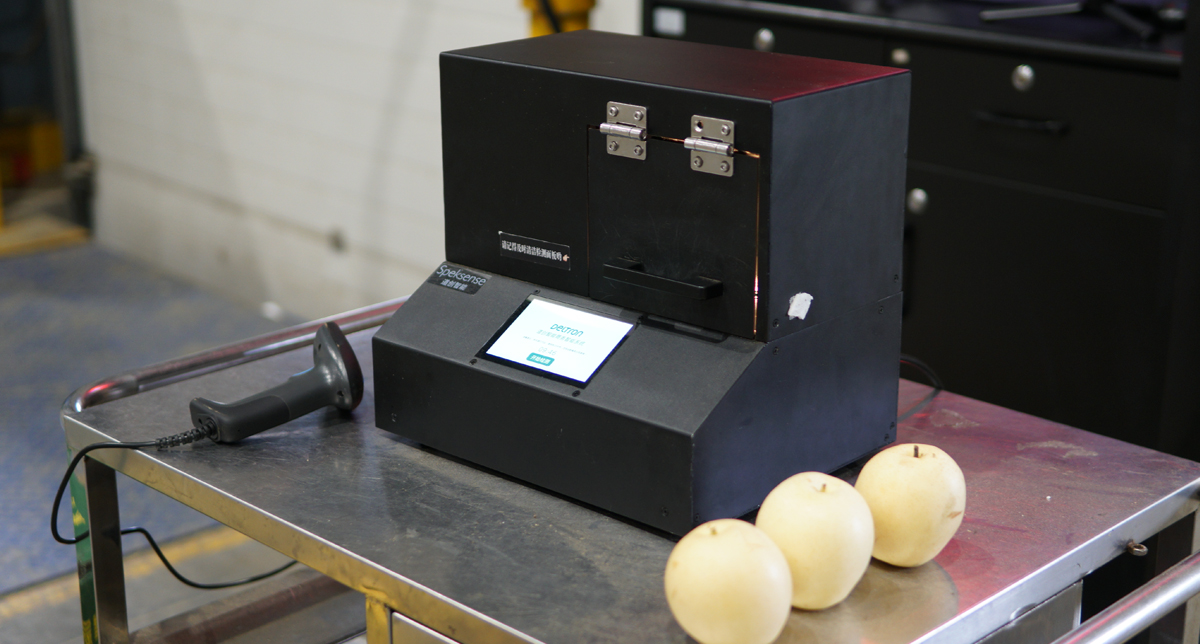

One such example of Chinese tech company putting AI to work is Deltron. The company provides intelligent fruit and vegetable grading and sorting solutions to the fruit industry; from major fruit producing areas to supermarket brands such as Walmart and Pagoda...

Read More: Digital Era for Taste Buds

Contact Us